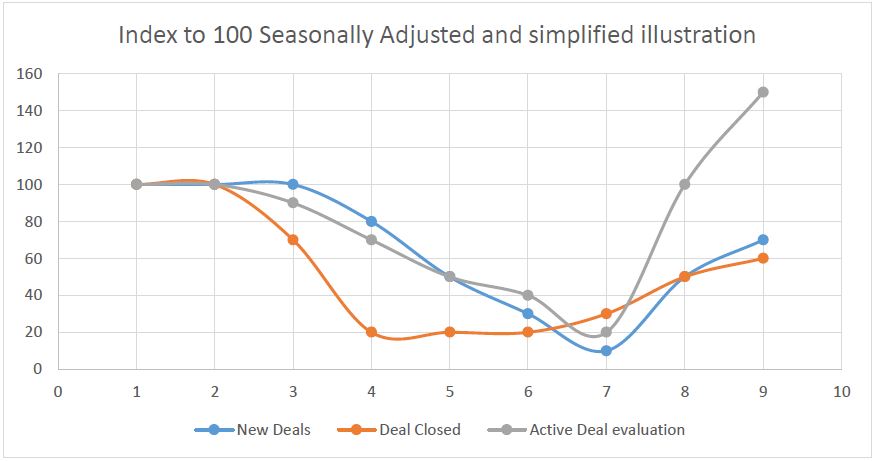

| As you know FaMAS screens hundreds of transaction per year and communicates with thousands of M&A professionals. Corona impacted in many ways how M&A and Private Equity deals are done. Last time I wrote about changes in valuation. Today I want to shed some observations on deal flow numbers. Here is what happened: |

|

| Clearly, March, April, May, June saw a significant drop of deals closed (red line) in Germany. Corona shocks came from Italy and Spain and made investors nervous quickly. Remember public stock markets dropped by 30% in March. In May data was published showing that 85% of deals in process stopped due to Corona. For the first time in a long time, I managed to answer all my inbox emails in a day. New deal introduction also dropped, yet in another speed. With a slight delay it reached the bottom in July. In May I started getting calls from investors with lots of cash who would never call me, asking for deals. Apparently, my empty inbox was not the only one. Things continued to drop until about July. In the middle of the summer some folks thought it is over and deal flow started to improve. In September and October I can clearly say that many investors were too busy with their existing stuff to even look at new opportunities (grey line). My unrepresentative survey of little Goldman and little Sachs seems to indicate a sudden shortage of time to look at new deals at all. It seems all deals stuck in Q2 were taking time to be done plus many new deals after the summer break. I get a sense that active deals in evaluation are now way beyond 100. Investors are drowning in fact books and teasers. As of today, 22nd of October, it still seems to be like that. This means now even good deals are possibly not getting the attention they would have a few months ago. Is this the real opportunity? Please let me know what you think about this per email or our blog on our website. Good deals ahead! Dimitrij |